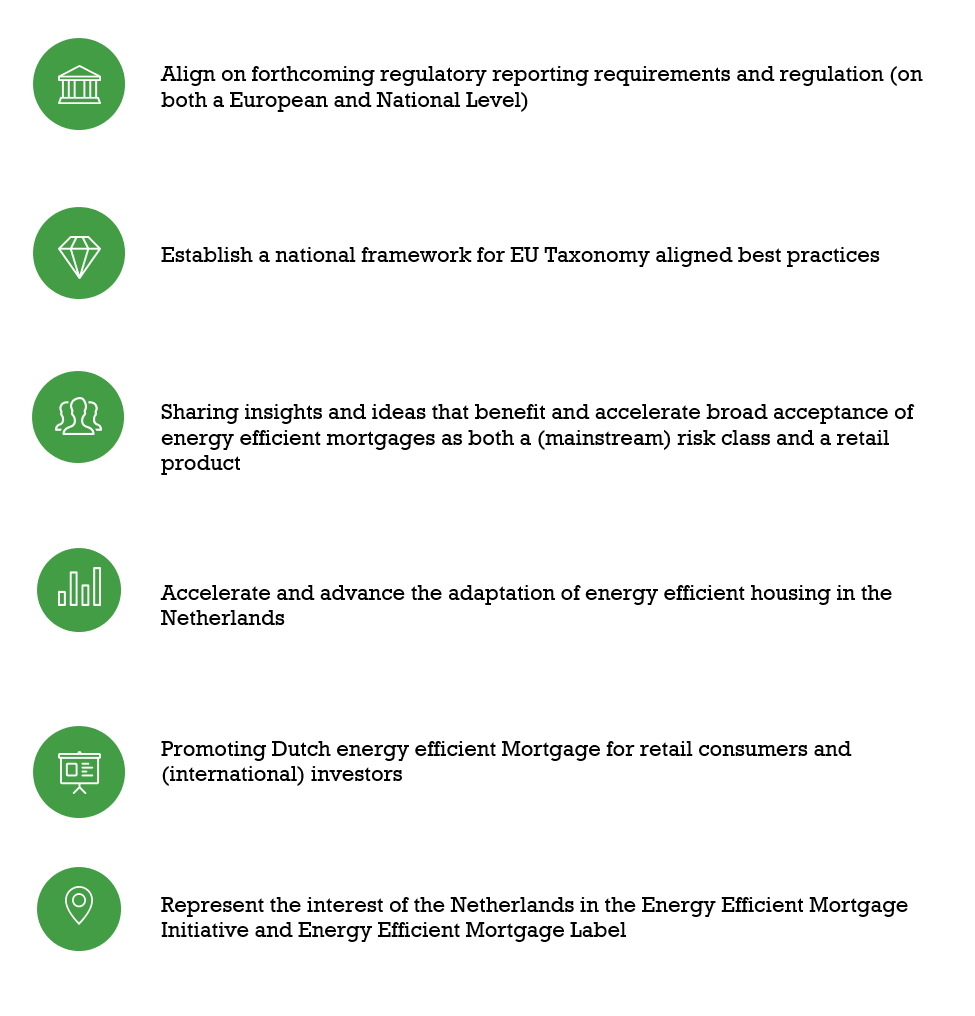

The Energy Efficient Mortgages NL Hub is an initiative from a wide range of stakeholders active in the Dutch residential mortgage market. It brings together mortgage lenders, investors and different service providers and other institutions. To promote the acceleration and adaptation of energy efficient housing in the Dutch market, 24 institutions active in the Dutch mortgage market have launched the Energy Efficient Mortgages NL Hub (EEM NL Hub). The EEM NL Hub aims to develop and maintain a Dutch framework for energy efficient mortgages[1] that facilitates the translation and application of European regulation into the Dutch residential mortgage and property market.

The Green Deal

To make Europe’s economy more sustainable, the European Commission presented the EU Green Deal at the end of 2019. The Green Deal has been enshrined into the EU Climate Law[2] which sets a legally binding target of net zero greenhouse gas emissions by 2050.

The EU Institutions and the Member States are bound to take the necessary measures on both EU and national levels to meet these targets. In the Netherlands these plans have been enshrined into the national climate and energy plan (NCEP) and ‘klimaatwet’.

Focus on buildings and mortgages

Buildings are responsible for approximately 40% of EU energy consumption and 36% of EU greenhouse gas emissions. Currently, in Europe about 75% of existing buildings are qualified as ‘energy inefficient’, yet 85%-95% of today’s buildings will still be in use in 2050. At present, every year about 1% of buildings undergo an energy efficient renovation[3]. In the Netherlands buildings are responsible for 35% of the overall energy consumption[4]. Improving the energy efficiency in buildings more swiftly and ambitiously therefore has a key role to play in achieving the ultimate goal of carbon-neutrality by 2050, as set out in the European Green Deal.

To meet the EU’s intermediate climate and energy targets for 2030 and reach the objectives of the European Green Deal, it is vital that investments are directed towards sustainable projects and activities. This is why the EU Taxonomy has been introduced by the European Commission which introduces a common language and a clear definition of what is considered as ‘sustainable’.

European and global initiatives, such as the EU Climate Law and the Paris Agreement should ultimately be ‘translated’ and applied to national regulation and (best) practices. The EU Taxonomy has been drafted on European level and the Dutch framework for energy efficient mortgages aims to provide a translation and application of the relevant sections of the EU Taxonomy into the Dutch national building code and local mortgage lending practices.

Green Mortgages – investors and consumers

The Dutch mortgage market is financed to a large degree through the capital markets, particularly covered bonds and securitisations but increasingly also through alternative investment structures. Dutch mortgages are an attractive and well sought-after investment, both due to their very strong credit performance and returns but also due to the high level of transparency provided by Dutch market participants.

To support the development of the market for ‘green’ financing of Dutch mortgages, it is critical that a common and transparent application of the EU Taxonomy in respect of Dutch mortgages is developed. The harmonised standard across different capital market transactions and structures as to be developed by the EEM NL Hub, aims to facilitate investors in committing to the ‘green’ financing of the Dutch mortgage market and by doing so contribute to the financing of the sustainability improvement of the Dutch housing stock. At the same time, the EEM NL Hub will seek close alignment with other sustainability initiatives such as for instance the PCAF initiative.

Transparency on what is considered a ‘green’ mortgage investment will also benefit consumers as it will directly indicate which measures contribute to improved energy efficiency. The development of a Dutch framework for energy efficient mortgages is also expected to stimulate product development and to lead to a wider offering of sustainable mortgage products.

[1] Known to most consumers in the Netherlands as green mortgages.

[2] The law sets the milestone of reducing net greenhouse gas emissions by at least 55% by 2030, compared to 1990 levels. Climate neutrality by 2050 means achieving net zero greenhouse gas emissions for EU countries as a whole by cutting emissions, investing in green technologies and protecting the natural environment. The law aims to ensure that all EU policies contribute to this goal and that all sectors of the economy and society play their part.

[3] https://ec.europa.eu/info/news/focus-energy-efficiency-buildings-2020-feb-17_en

[4] Monitor Energiebesparing Gebouwde Omgeving, RVO 2019